Investor/User Dashboard

The software is an engine, which enables users (Investors, Backers or Purchasers) to have a Dashboard that assists them to manage which companies they invest into or products they purchase (Bonds, Debts, Equities, Commodities, Credits) and automates the purchase and subscription to such securities or products.

The user enters full KYC and FICA based information for their individual or company capacity, and registers with the system as to their level of sophistication as an investor. The process automates which securities they qualify to invest in and which ones they are capable of viewing under the securities laws and regulations of the Country.

The Investor:

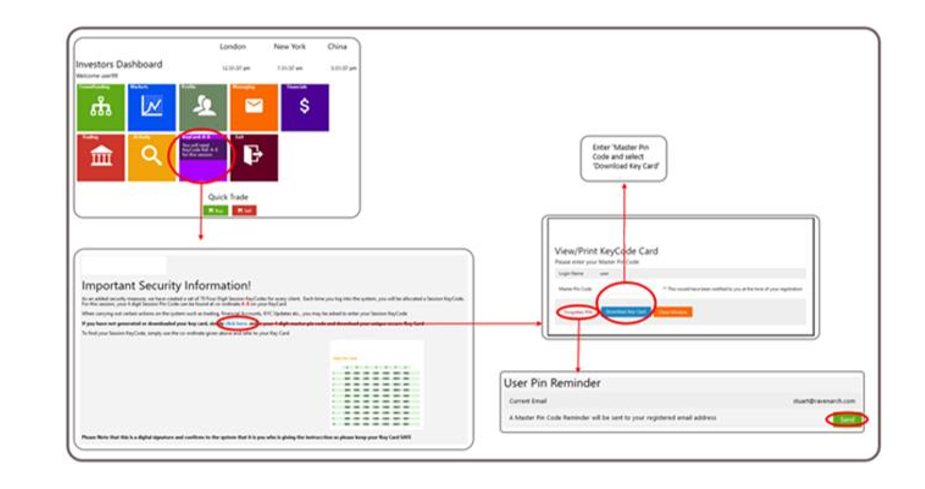

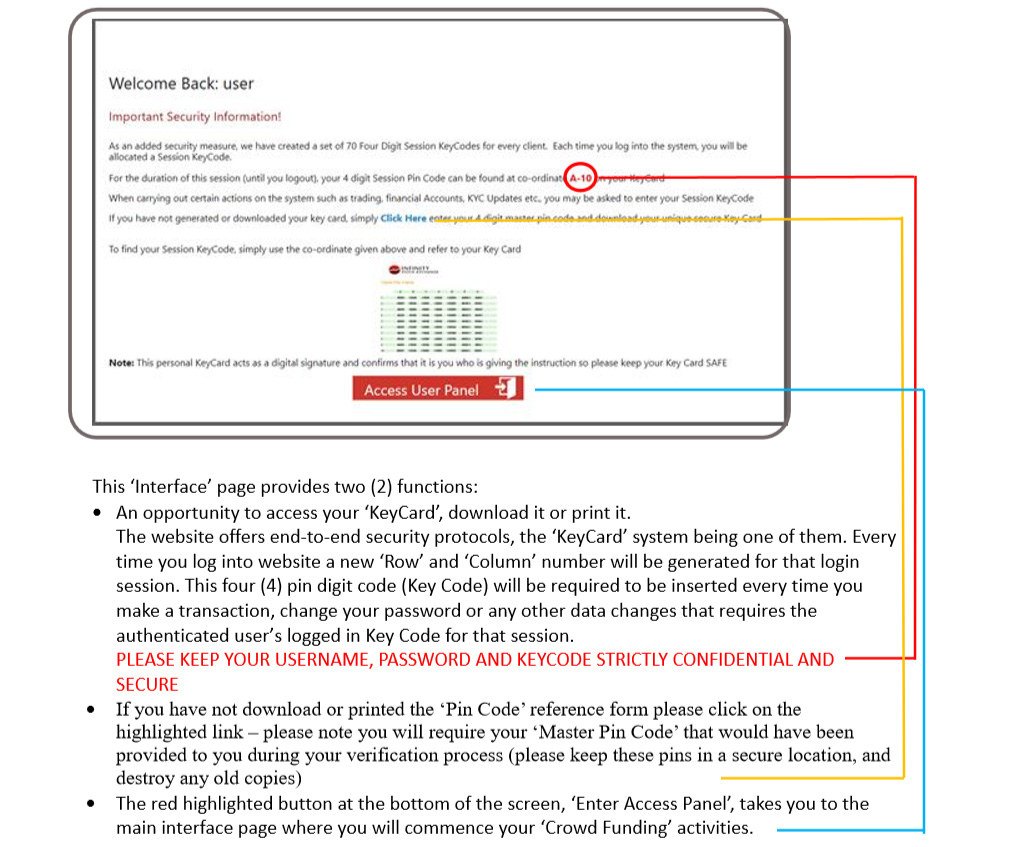

The investor joins by signing up through the internet to the online platform, supplying their KYC information and documentation, and choosing an exchange broker, or having one appointed to them. A double pin is produced, where by there is a user identification card with over 54 various PINs assigned to the user. A second card is provided with over 54 double digit pins. The two pin cards that only the investor has are capable of allowing the user to login, make trades, make transfers, request funds, etc. Therefore, any investor initiated activity is strictly secure. For example, if the investor is making an investment into a private placement, the system produces the PDF document, and they can electronically sign, only by entering in the cross reference of pins.

Login and Security:

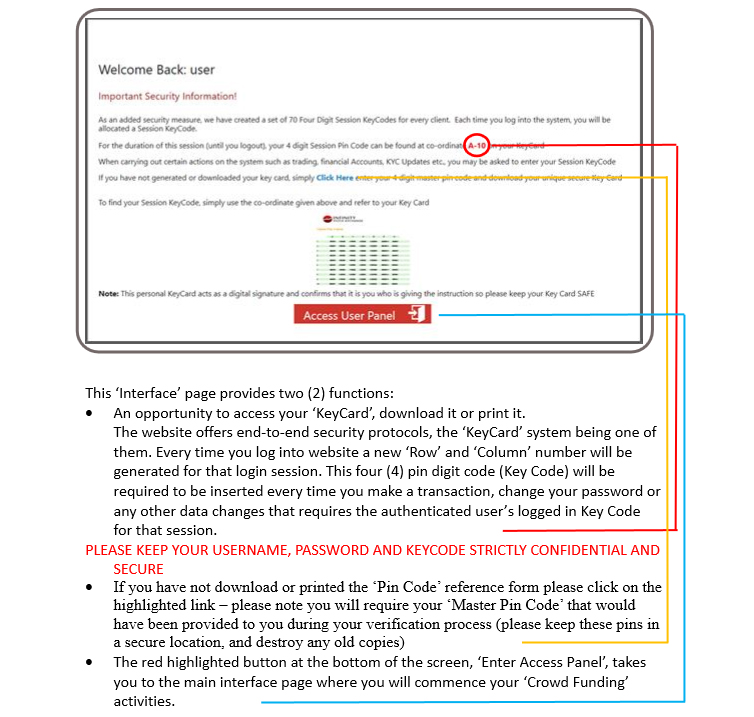

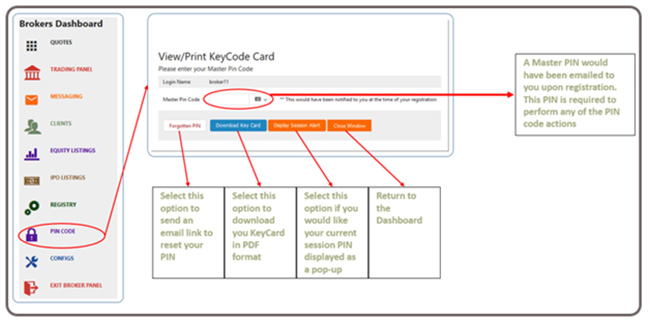

Two pin codes are supplied to each investor, one of which is a card with randomly different PINS printed. These PIN codes are unique to the investor. One card is a series of 4 digit codes, one PIN chosen by investors. To make any activity within the system that involves trading, money, communications, and or request for information, the investor must identify that they are who they say they are by entering in their personal PIN, and then a PIN from the cue card. This cue card pin randomly alternates, someone may login with the personal pin and the exact 4 digit requirement, but then to make a trade, you would be asked again to put in your personal pin and a new 4 digit pin from the card. This insures that even if someone left their computer logged in, they could not take any actions on the client account without having the PIN card. New PIN cards can be requested by investors through a series of password recovery questions and private details. However, for the ease of client and broker relationships, an investor can simply call a broker dealer on the system to make a trade if they are not technically inclined or do not have their PIN card. Therefore, the security is really for investors who would like to take online trading into their own hands.

Brokers also have a similar PIN based system of which trades cannot be done for themselves or clients without entering in the PIN for that trade, so that every individual trade is verified.

Restricted and Unrestricted:

The platform has either restricted shares which investors can buy and brokers who sponsored the listing can sell, or unrestricted shares which any one can buy and sell. This goes for all products within the system. If an investor goes to a restricted product, they will see a restriction notice, and only have available the ability to buy, not to sell. If the securities are unrestricted, they can choose to sell the shares into the market. The issuer essentially has the ability to apply for the restriction to be removed from shares within the electronic trading system. All shares in a single offering are either restricted or unrestricted. One investor doesn’t get the privilege of having unrestricted shares while others are unrestricted, it is either one or the other for complete fairness and transparency. However, a company can make two offerings, one which is restricted, and one which is unrestricted. They can also place restricted and unrestricted debts, bonds, carbon credits, and contracts. The rules are essentially the same for trading.

Minimum Quantities:

Based on the offering documents filed with the exchange, there may be minimum quantities, a notice will come up for investors if they have asked for less than the minimum. Therefore, in regulated areas such as Europe where 50,000 to 100,000 euro may be a minimum unit, this would stop individuals from investing less than this amount. This also greatly depends on the Broker interaction with the investors.

In the event that it is a sale of shares that falls under a new crowd funding regulation, where offerings can be done on a micro scale, this minimum could be $1 for example but maximum of $2,000. This essentially is set by the issuer or offering party. The exchange must however approve and verify the minimum quantities in interest of the investor before allowing offerings to be made.

Financials:

The entire system is run on three currencies, US dollar, Great Britain Pound Sterling, and European Euro. (Potentially BitCoins in the future.) Every investor and broker have 3 bank accounts of which they can order shares from. Issuers can list in the three main currencies. If an investor has US dollars and decides to invest in Euro’s, they are prompted with a real-time currency exchange quote and asked to accept it with their double pin code combination. Clients can move funds from one currency to another real-time between these three currencies. Account holders can:

- Transfer between accounts

- Make a trade in one currency and agree to transfer the funds in another currency to cover the trade

- Add funds to the designated accounts in all three currencies with unique PDF wire instructions downloadable on request for their specific account

- Withdraw funds from the account in the currency originally deposited or to the clients account if they have one in the currency requested (transfer charges and account minimum balances do apply)

- Trades are directly deducted from the currency account of which they are listed in, issuers take on any currency risk from foreign investors.

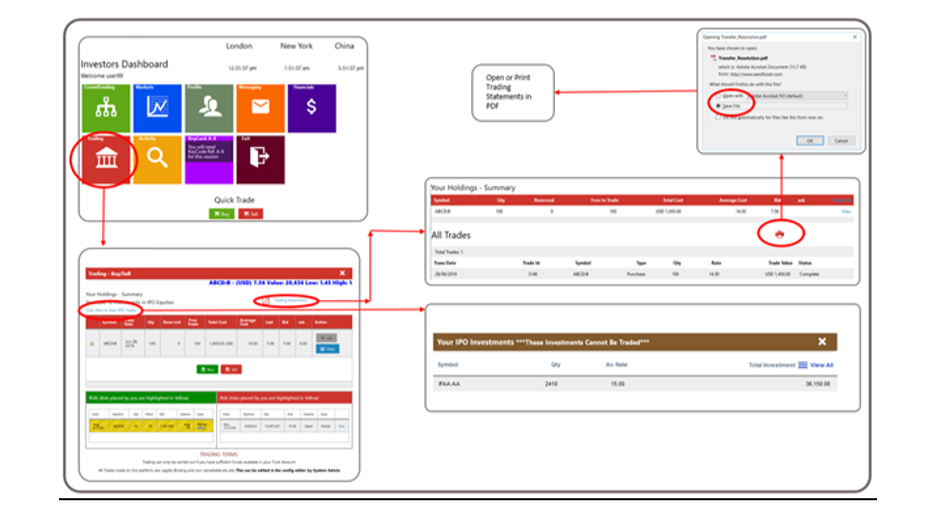

- Statements can be requested via email, in pdf, or mailed to clients (subject to minimum balances and fees)

Buying and Selling Shares

In general, Venture firms will have shares that can be bought from the issuer but not sold into the market, as they would have some kind of hold or restriction. Therefore, on these companies there is a BUY but no SELL option on the screen of the company. Companies whose shares are free for trading will have both a BUY and SELL option.

Status’s of a Trade:

Processing: A processing trade cannot be cancelled, this means that the resolution for issuing the shares has already been sent to the transfer agent for uploading shares into the brokerage account.

Pending: This means that the trade has not been put into processing yet, and can be cancelled until the status changes. This can be cancelled by the investor, or by the broker dealer who may not accept the trade.

A completed trade simply shows with the shares in the financial account of the client.

Information Tools:

News: This is the press releases of the particular stock.

Alerts: This includes Portfolio alerts, account balance alerts, watch list, suspension alerts, financials and filing alerts, activity alerts on stocks going up or down.

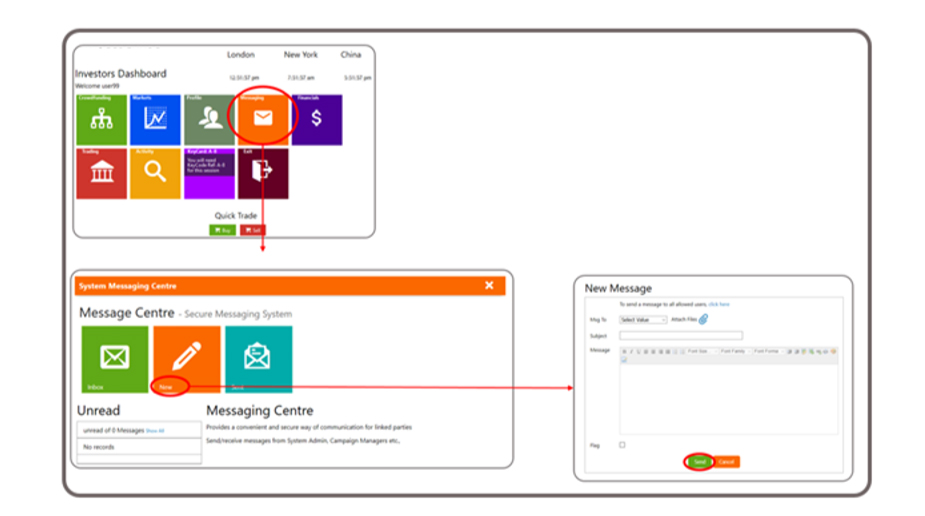

Messaging: This is a tool for investors and their broker to communicate on, in addition, alerts and releases can be sent to the message system.

Groups: The groups section is for an investor to create a group of which other investors on the platform follow and possibly subscribe to by investing with the group.

Funds: This is the account balances and reload information for adding additional funds.

Settings: Within the settings section, the investor can configure their account.

Investor Charges:

1.5% of the transaction value to buy paid to the Exchange (0.5% to the Broker)

1.5% of the transaction value to sell (0.5 to the Broker)

Certificates in physical form $100 (Courier fees paid by the issuer)

Electronic Certificate $25

To put a certificate back on the platform, there is a dematerialize fee of $125

Other Revenue Sources:

Within the top and bottom of the user interfaces there is ample space for banner advertisements which could be purchased by consultants, advisors, issuers, and public relations companies.

LOGGING IN

Before a ‘User’ is able to log into the Seedfundr website a registration process is required and must be completed. The registration process is to provide you with a ‘Username’ and ‘Password’ which will be used throughout the duration of your activated account.

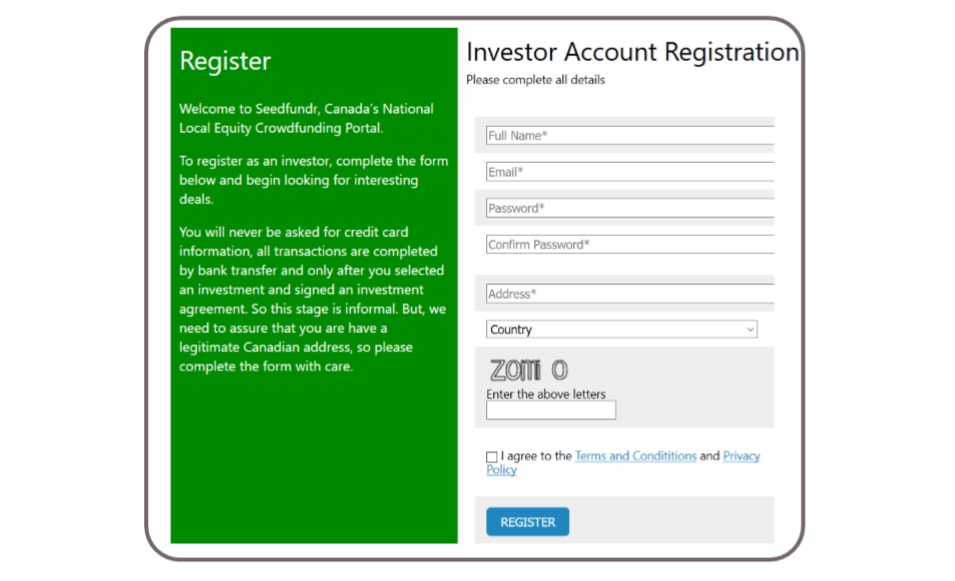

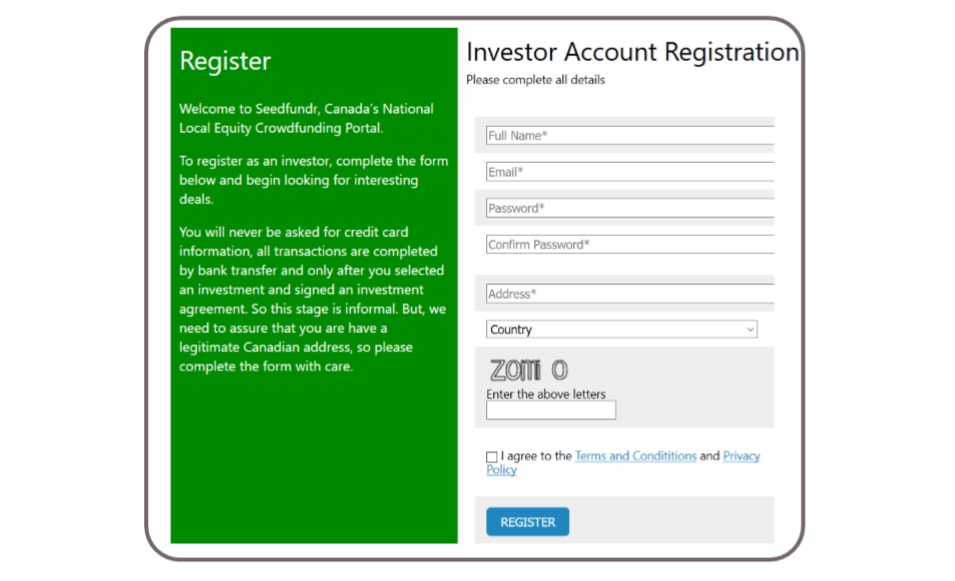

To register please follow the below instructions:

- Open your Internet browser on your computer (please note an active internet connection is required to proceed to the next steps)

- In the ‘Address’ bar of your browser insert the following URL: www.seedfundr.com or simply ‘click here’, the below screen shot shows the correct navigated page:

3. To register click on the ‘My Account’ heading, and select ‘Create Account’:

4. The below screen shot displays information that is mandatory to be completed: (Please note this information is only to validate your Canadian Residency, no Credit Card information will be requested)

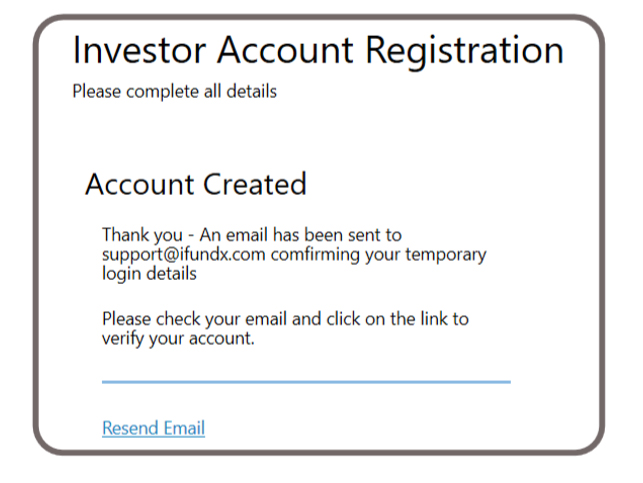

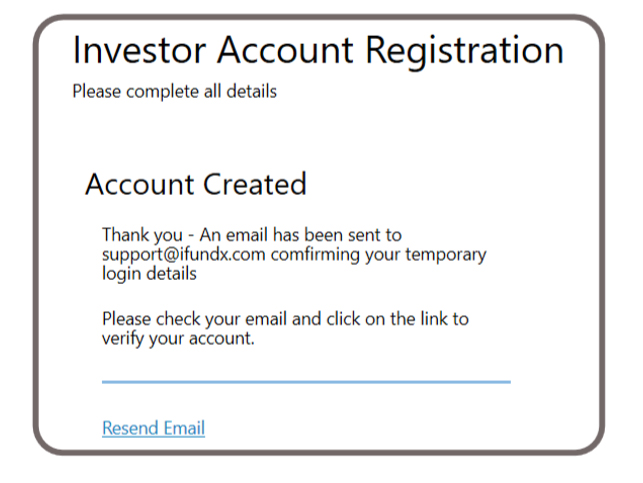

5. When the ‘Investor Account Registration’ form is populated with your required information, select ‘Register’ – the below screen shot or confirmation of registration will be displayed, if you did not receive a confirmation email, click on ‘Resend Email’:

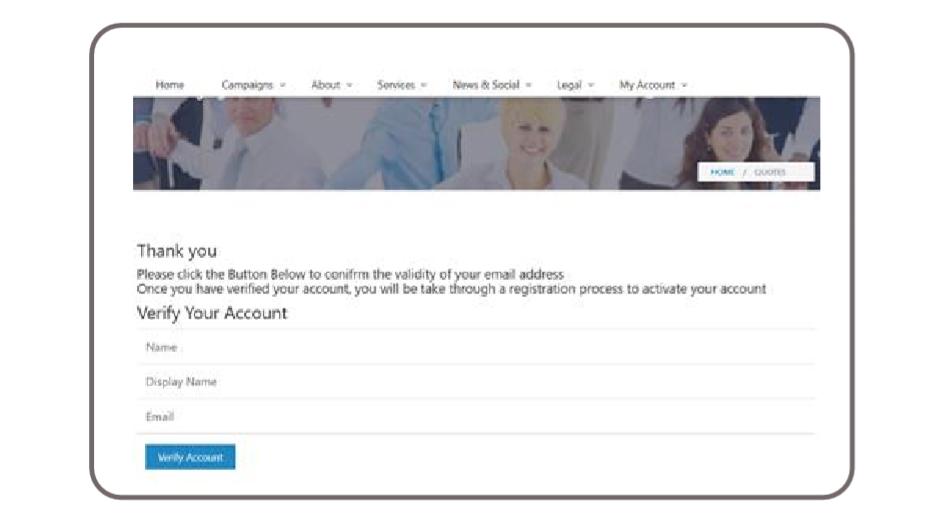

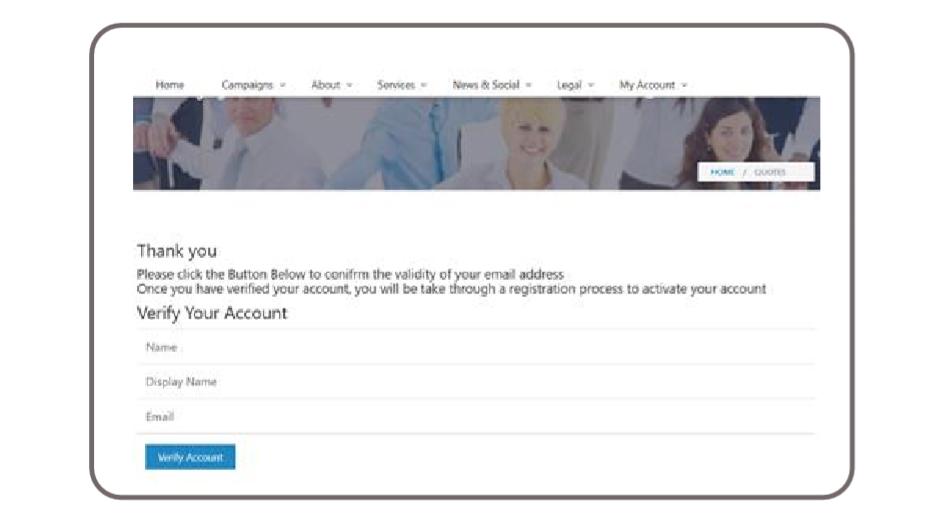

6. The below screen shot displays the website after selecting the link in your email account. Please select ‘Verify Account’ to continue:

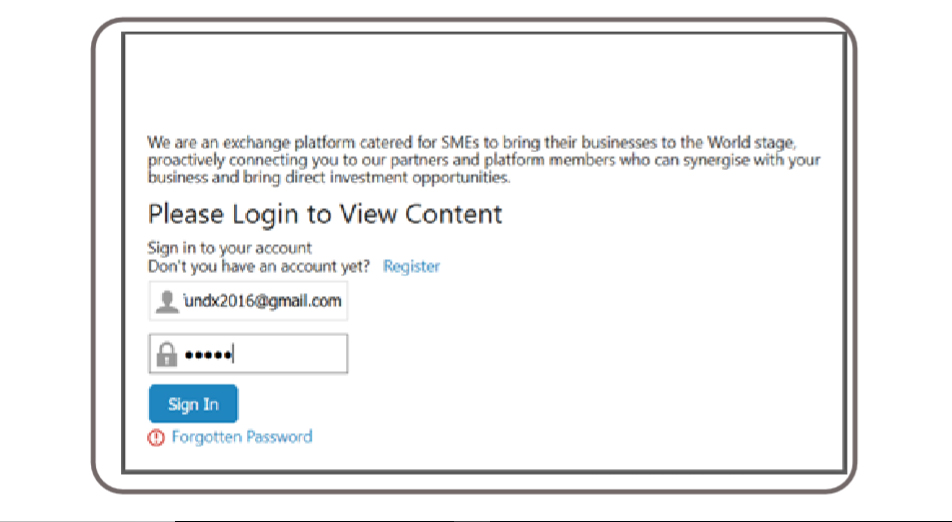

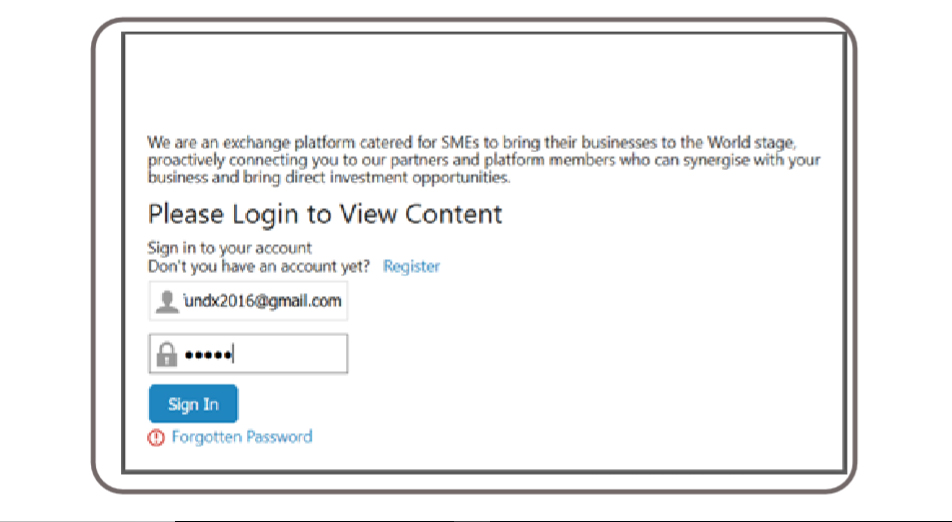

7. After clicking on ‘Verify’ you will now be able to log into your account, the below screen shot will be the screen visible to perform this action:

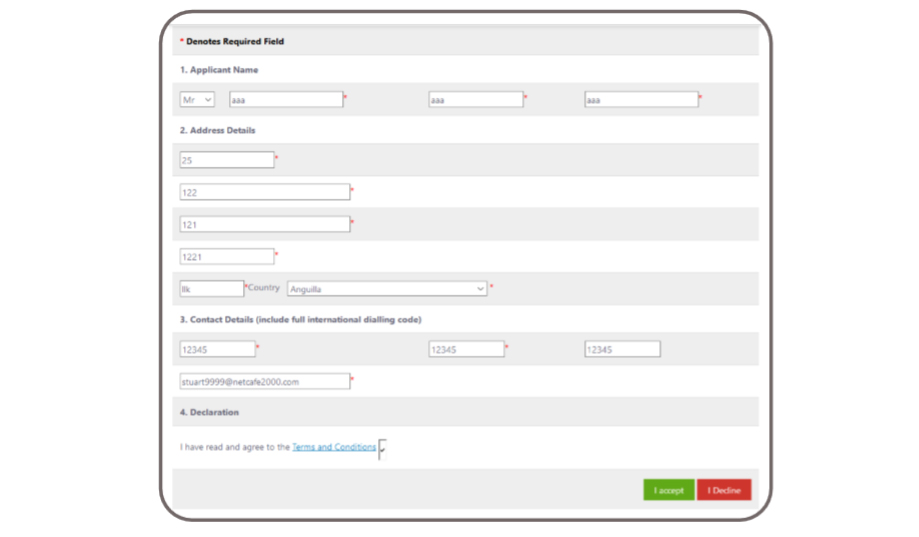

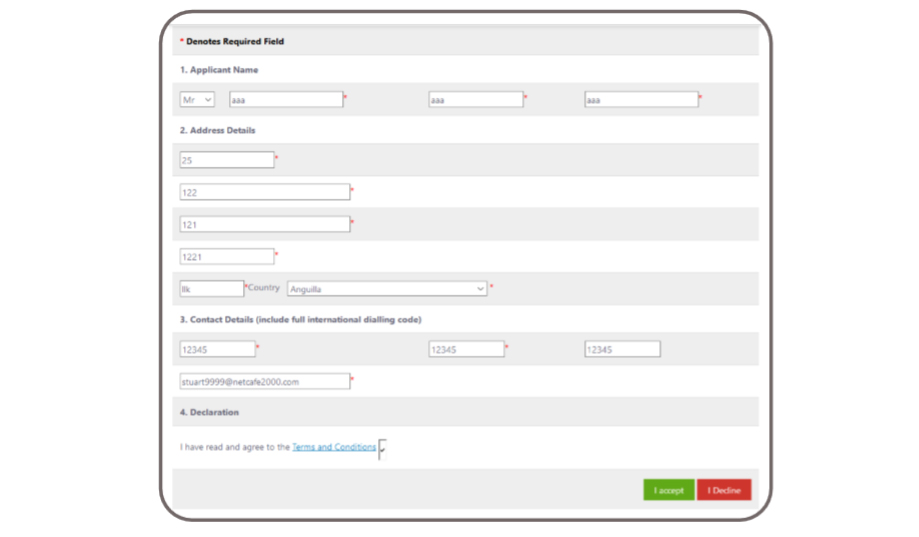

8. After your account has been verified the client will be required to complete the below form and accept the terms and conditions of the use of the website:

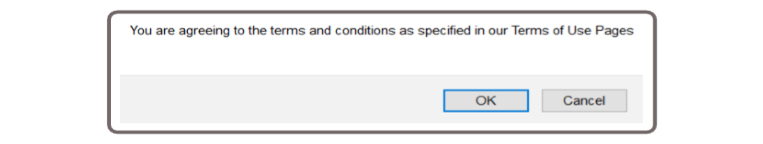

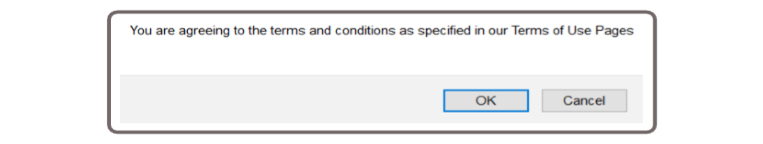

9. After selecting ‘I Accept’ a secondary prompt as displayed below will be shown, the client will be required to select ‘OK’ in order to continue:

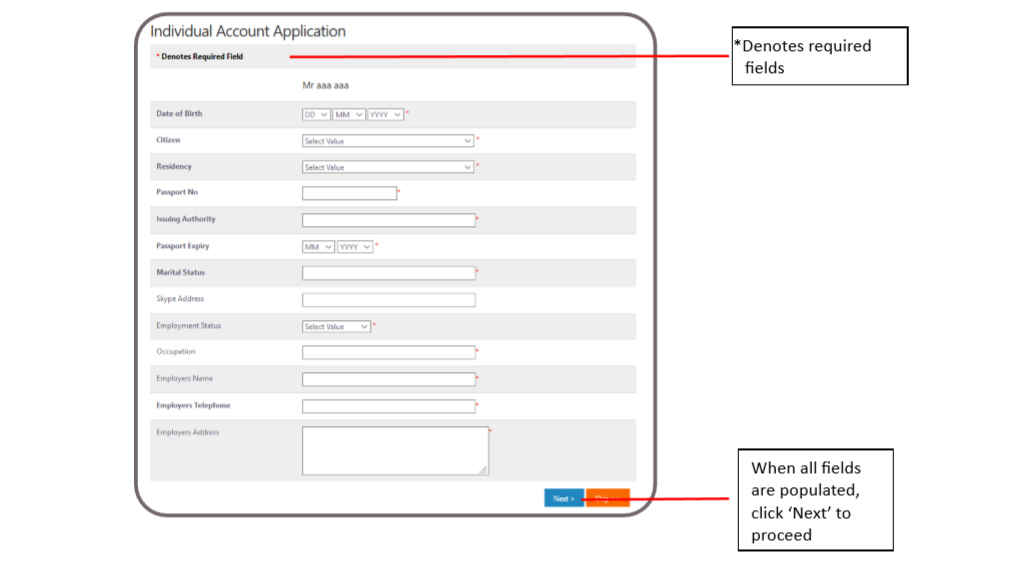

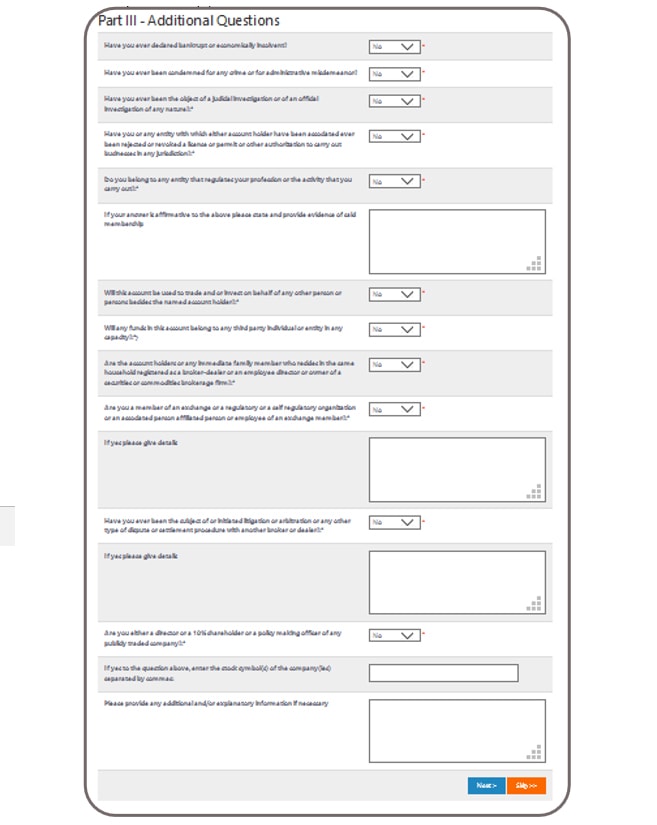

10. After accepting the Terms and Conditions the client will be required to complete the ‘Know Your Client (KYC)’ documentation. ‘KYC’ for one (1) is shown below:

11. ‘KYC’ part two (2)

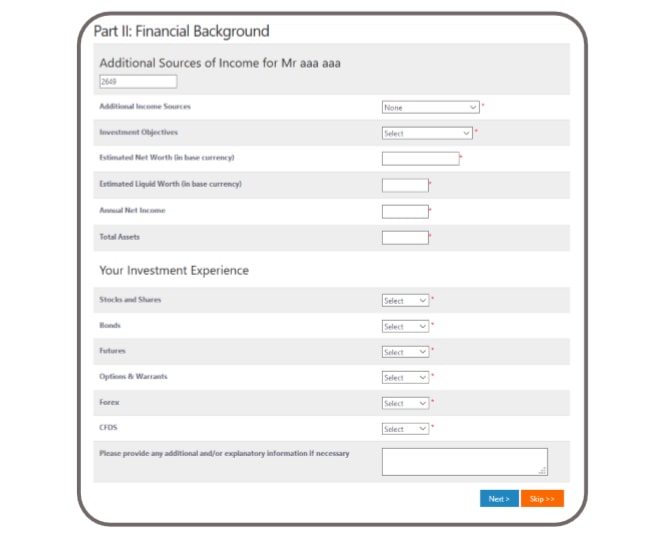

12. ‘KYC’ part three (3):

13. ‘KYC’ part four (4):

14. NB: Once your ‘KYC’ documentation is successfully completed and lodged this will be reviewed by a Compliance Officer or a Broker. Your account will remain in a pending state until review is completed and verified. The client may continue to the Seedfundr site, however ‘Trade’ will not be allowed until ‘KYC’ documentation has passed Compliance.

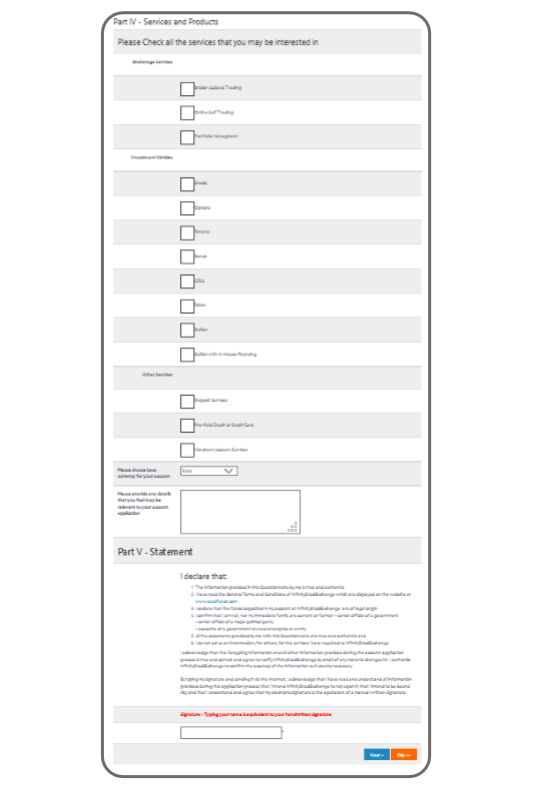

INVESTOR DASHBOARD

Our dashboard offers various easy to use modules, which include Crowdfunding, Markets, Customer Profile, Financials, Trading, Messaging, KeyCard, Activities and Exit.

The below Dashboard is displayed as a logged in Investor. There are four (4) alternative Dashboard displays each for a Broker, Company, Admin and Compliance, which all have interlinked / activated modules pertaining to the permissions and functions for each:

Crowdfunding:

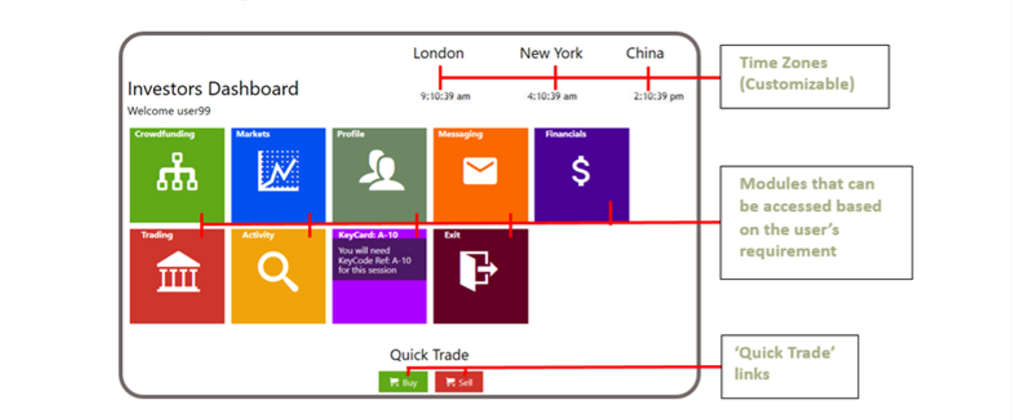

The Crowdfunding module allows the end user to either view existing Campaigns (no sign-up required) or create a Crowdfunding Campaign to raise funds (sign-up required and due diligence in terms of customer KYC required), or invest in an existing Campaign (sign-up required).

The following content under the Crowdfunding module needs to be incorporated:

- Campaigns already live / active to be displayed in the following manner

- Random, by latest or oldest (date), high to low capital raised, region (alphabetical order)

- If an unregistered user views campaigns point 1 is applicable, however for registered users a Contribute Now button must be made active.

- When viewing / selecting a specific Campaign the following information / menu items need to be incorporated

- About, Date set live, end date, image gallery, video gallery, etc.

- Clear display of capital raised in figures and percentage against target amount.

- Social media links if Campaign has been set up as per customer.

- The ability to allow a user to sign-up and create their own Campaign, this will include a prescribed checklist that will include the following

- Documentation

- Images

- Videos

- Social media links

- About

- Profile picture

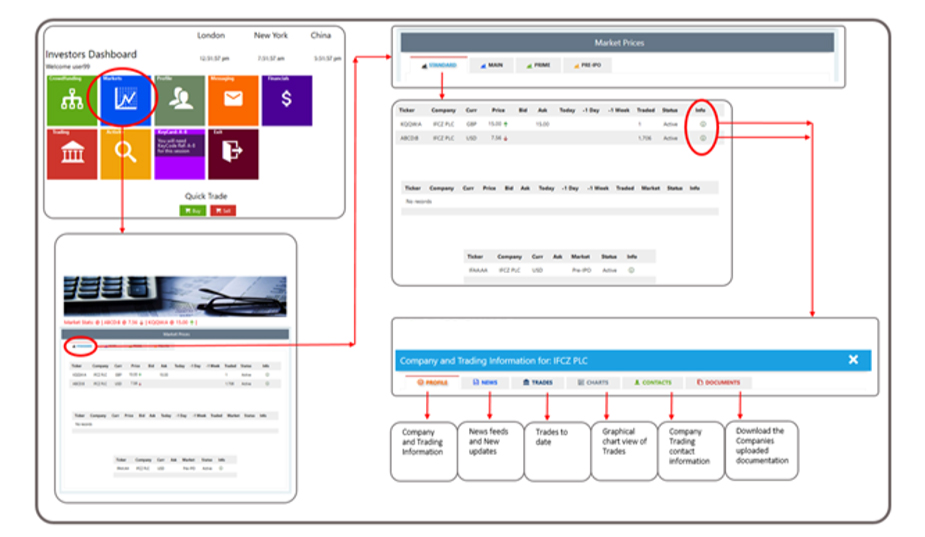

Markets:

The Crowdfunding module allows the end user to either view existing Campaigns (no sign-up required) or create a Crowdfunding Campaign to raise funds (sign-up required and due diligence in terms of customer KYC required), or invest in an existing Campaign (sign-up required)

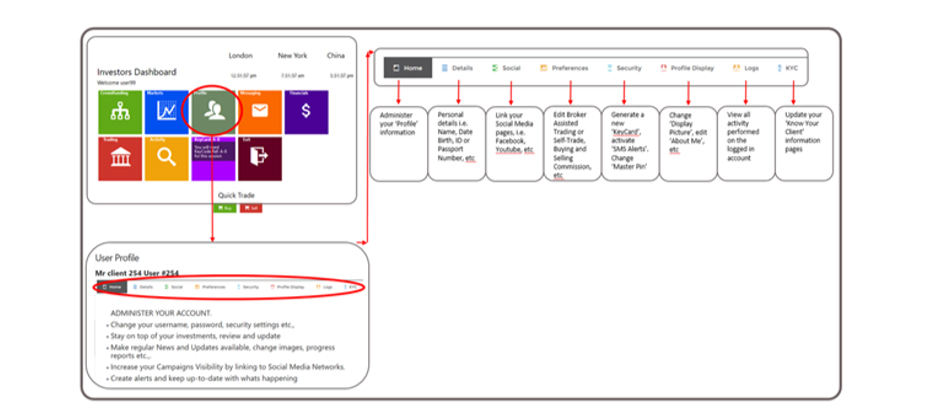

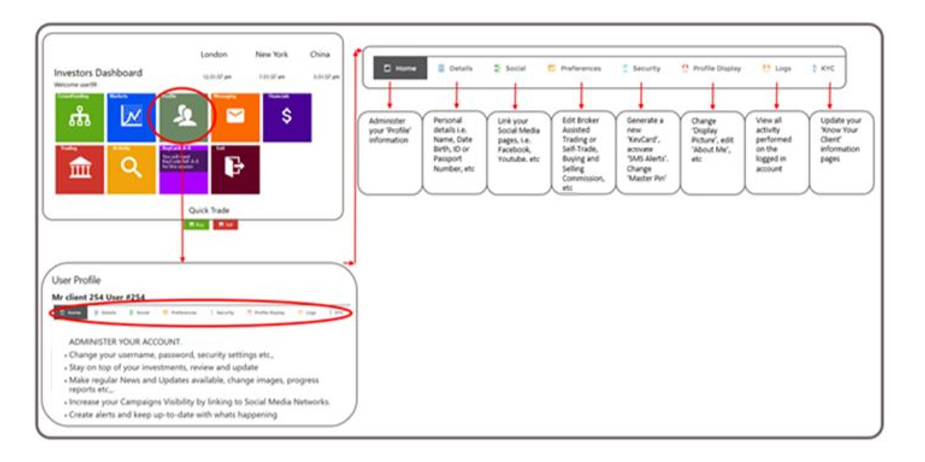

Customer Profile:

The Customer Profile module is a detailed page only available to the logged in user, Company login, Broker, Compliance as well as Admin. This page will have menu items required or needed for updating the client’s specific details, documentation, etc.:

Financials:

The Financial module will include drop down menus including all transactions performed on the user profile, which will include any transactions performed on and behalf of the user if the client has selected Broker Assisted Trading:

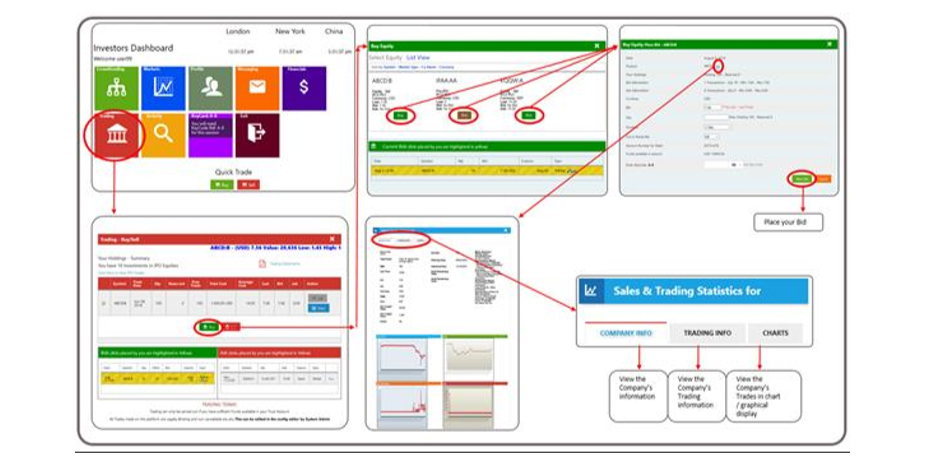

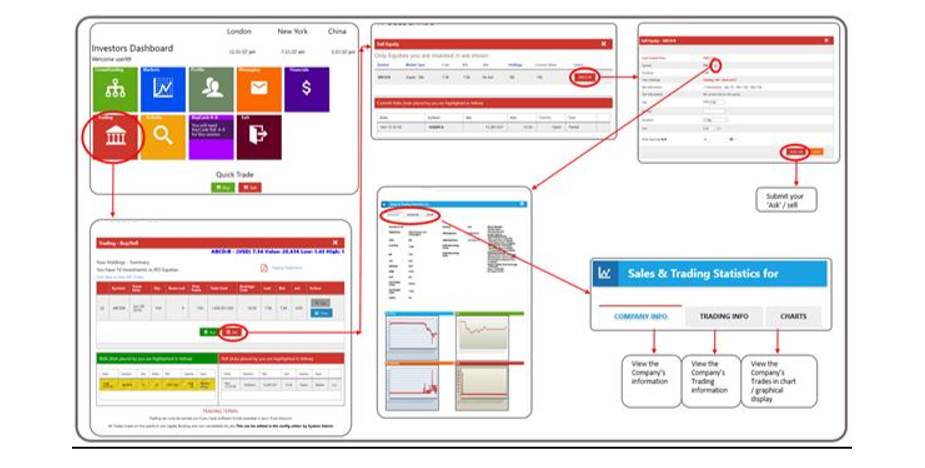

Trading:

The Trading Module is the primary location for selling or buying / purchasing shares or stock:

Messaging:

The Messaging module is a unique and internal messaging system to allow users, company, compliance, admin and brokers the ability to communicate. This module is also utilized for admin, compliance and company logged in users to send bulk messages to their clients updating them on news or general information notices. The messaging service also enables the end user to report Trades that may appear suspect which is immediately flagged for Compliance intervention:

- Inbox: All messages received by other clients, administrators and important news articles (RSS Feeds). Campaigns being followed will also be displayed in the ‘Inbox’ as well as any ‘Alerts’.

- Sent: Any messages ‘Sent’ by the logged on user to other clients and administrators will appear here.

- Deleted: Any ‘Deleted’ messages will temporarily be stored in this folder, however the Systems backend will always contain a record of ‘Deleted’ messages for security purposes.

KeyCard:

The KeyCard module forms the basis of authenticating a logged in user or broker with a unique generated KeyCard which allows Trades or Financial transactions to be performed:

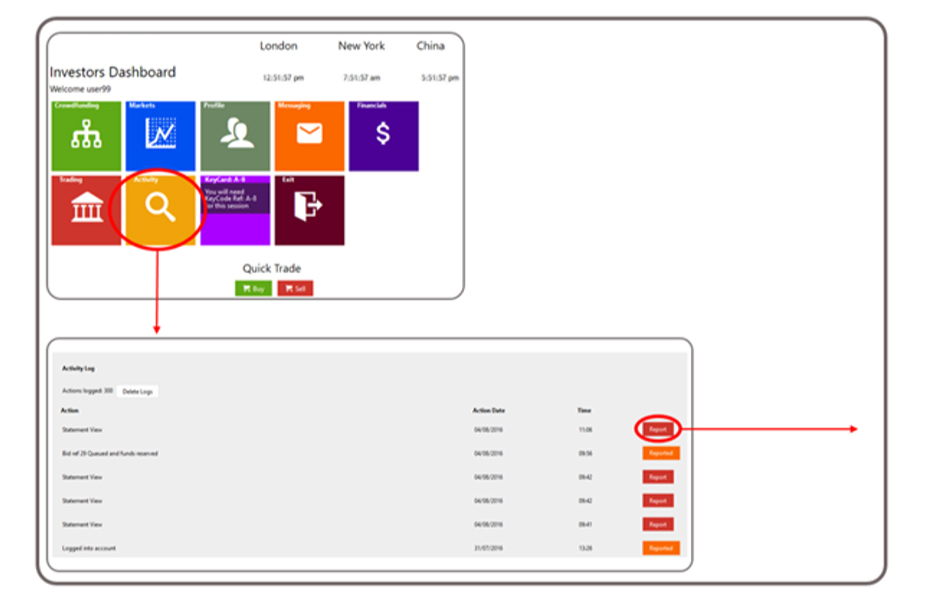

Activity:

The Activity module records all activities perform on the users profile either by the user or on and behalf of broker assisted brokers. These activities include login times, any changes to the user profile, updated information or documentation, all Trades, Campaign creation, etc.:

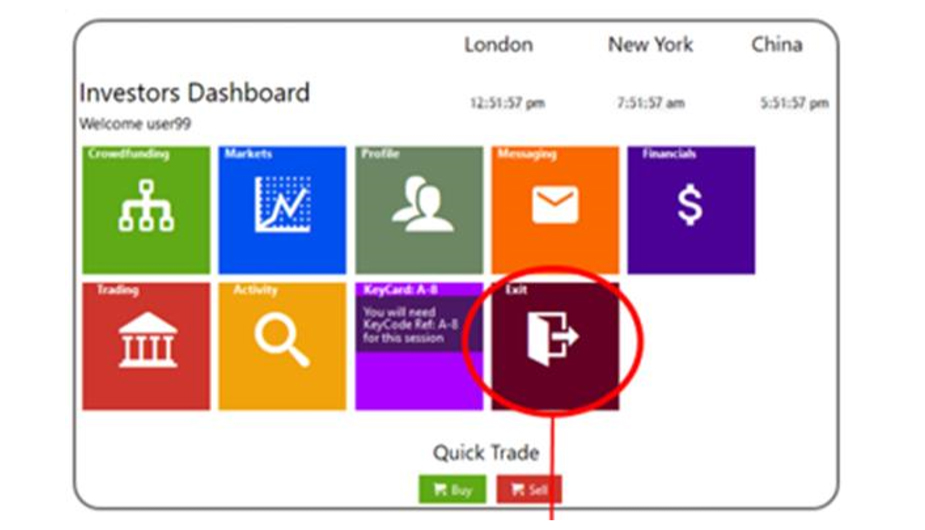

Exit:

The Exit module allows the logged in user to successfully log out of their session for security purposes. Please note that a built in session timeout is enabled by default of fifteen (15) minutes unless requested by the company to extend or deactivate this security feature:

BROKER DASHBOARD

Our dashboard offers various easy to use modules, which include Quotes, Trading, Messaging, Clients, Equity Listings, IPO Listings, Registry, Pin Code, Configs and Exit.

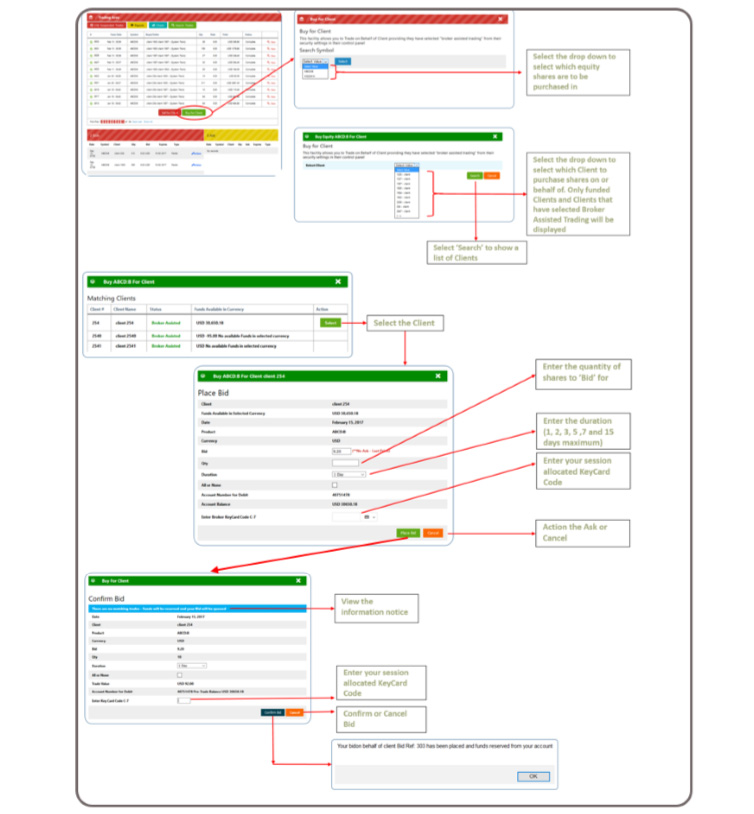

The broker has the following options, accept or reject order.

Once order has been accepted it will be processed in accordance with the order processing module criteria described more fully below Note: All trades require the entry of the users/brokers PIN code to proceed.

Buy Order Processing:

On acceptance by the Managing Broker of an order, the following processes happen

- Funds are reserved from the buyers account (if there are insufficient funds available in the investors account, the trade is processed with a “Pending Funds” Status)

- Funds are credited to the Managing Broker (if there are sufficient funds available otherwise the trade is processed with a “Pending Funds” Status).

- If the order is a Broker2Broker transaction, A buy order is raised from the managing broker to the sponsor broker – The managing broker can set his own bid price.

- If the order is accepted by the sponsoring broker, funds are transferred from the managing broker account into the sponsoring brokers account

- The system produces a Contract Note or Subscription Agreement (or other documents as programmed by the sponsoring broker at the time of listing product) and emails to all parties

- A full audit trail for all orders is linked to the order

Client Snapshot:

Each client has a snapshot available to the broker, including pending trades, documents, balances, uncleared funds, cleared funds, withdrawal requests, alerts, etc.

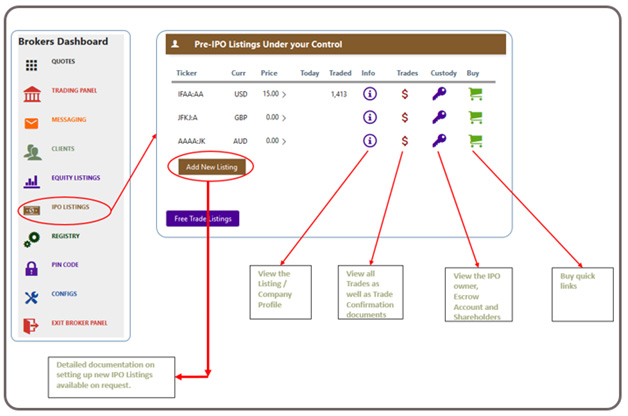

Sponsor Broker:

Within the Broker section, there is the option to sponsor companies onto the exchange. If an issuer doesn’t have a sponsor, the software recommends a Broker by sending messages out with the application. Within the Sponsor section, a Broker can Add Listings, Set Broker Introduction Fees, and review the Issuer Client Snapshot.

Within the sponsor broker section, there is an Issuer Client Snapshot which includes:

- Shareholder list

- Pending shareholders to be given certificates or electronic shares

- Uploaded compliance documents, such as contracts, financials, resolutions, and material events.

- Giving and Receiving Client Notifications for compliance

- Status which is Pending, Active (Listed), Delisted, Suspended, Halted

Broker Trading:

Brokers can set the platform to auto-trade on behalf of their client, which means the client makes the trade and it automatically is placed if the funds are in the account or manual trade, which means the broker deal checks every trade and approves them manually before they are completed. For every trade in the system, the broker dealer gets a Trade Alert.

Brokers Fees and Costs:

Brokers will collect fees by,

- Charging issuers to be their sponsor broker

- Taking a 0.5% commission for BUY trading the clients account from the 1.5% charged by the exchange.

Sponsor Brokers may have up to a 10% commission on the SELL trading of an Issuer’s stock of which they are the sponsor broker. In the event the BUY broker and the SELL broker are not the same broker, the sponsor broker would split their commission. However, the sponsor broker can electronically alter the commission within the system which would be advertised to the other brokers, whereby they may take 2% and give other brokers 8% or any variation of splitting the fees. This is manual change of commissions which can differ from company to company, but otherwise the default is a split commission unless otherwise altered.

LOGGING IN

Before a ‘Broker’ is able to log into the AltSX website a registration process is required and must be completed. The registration process is to provide you with a ‘Username’ and ‘Password’ which will be used throughout the duration of your activated account.

To register please follow the below instructions:

1. Open your Internet browser on your computer (please note an active internet connection is required to proceed to the next steps)

2. In the ‘Address’ bar of your browser insert the following URL: AltSX.com or simply ‘click here’, the below screen shot shows the correct navigated page:

3. To register click on the ‘My Account’ heading, and select ‘Create Account’:

4. The below screen shot displays information that is mandatory to be completed:

(Please note this information is only to validate your Canadian Residency, no Credit Card information will be requested)

5. When the ‘Investor Account Registration’ form is populated with your required information, select ‘Register’ – the below screen shot or confirmation of registration will be displayed, if you did not receive a confirmation email, click on ‘Resend Email’:

6. Check your email that the account was registered with and click on the ‘Verify Account’ link.

7. The below screen shot displays the AltSX site after selecting the link in your email account. Please select ‘Verify Account’ to continue:

8. After clicking on ‘Verify’ you will now be able to log into your ‘AltSX’ account, the below screen shot will be the screen visible to perform this action:

9. After your account has been verified the client will be required to complete the below form and accept the terms and conditions of the use of the AltSX site:

10. After selecting ‘I Accept’ a secondary prompt as displayed below will be shown, the client will be required to select ‘OK’ in order to continue:

GETTING STARTED

- Once you have successfully logged into the AltSX website the below screen shot, upon every successful login, will appear:

Quotes

Click on the ‘Quotes’ module to view Market Prices and to drill down each of the listed companies:

Trading panel

The Trading Panel is the module where the allocated Broker will ‘Buy’ and ‘Sell’ shares on or behalf of a client:

The below process flow defines the ‘Selling’ of shares for a Client:

The below process flow defines the ‘Buying’ of shares on or behalf of a Client:

The below process flow defines how to update or delete your bids or asks:

MESSAGING

The Messaging Panel allows the Broker to view Inbox messages, send messages to Admin and view already sent messages:

CLIENTS

The ClientsPanel allows the Broker to view all clients under his/her profile. The Clients Panel allows for the Broker to search, drill down any individual clients profile, view verified and non-verified clients, broker assisted clients, quickly view clients that have funds to trade, KYC documentation, add new clients, and add notes and so much more:

EQUITY LISTINGS

View the existing Equity and IPO Listings. A checklist of required documentation for Compliance is available for review. This module also allows the Broker to set up new Equities and IPO’s however will only be approved after Compliance has reviewed the content and:

EQUITY LISTINGS

IPO Listings module enables the Broker to add new IPO Listings, Listings / Company Profile, Trades within the individual Listings, the IPO owner information, Escrow Account, Shareholders and Trade Confirmation documents:

REGISTRY

The Registry module provides the Listed Equities full Register, Resolutions, Traded Shares, Shareholders, Reserved Shares, Transferred Shares, Pending Shares, Rejected Shares, as well as the ability to process the Sales Register. The added Search utility has been added for ease of.

- Resolutions are uploaded for the registrar to download and issue certificates from. Resolutions either say dematerialize the shares, which means to deposit them in the exchange keeping the record with the registrar, or to certificate, which means the shares are couriered to the shareholder and their account within the system is empty.

- For shares to be sold between shareholders, there is a transfer document signed by the SELLING party, which transfers the shares to the exchange, and then the exchange transfers the shares to the BUYING party.

- The registrar has an online copy of the shareholder list.

PIN CODE

Clicking on the ‘Pin Code’ module allows the user to download, print or display the current allocated ‘Pin Code’ session (4 digit number). This 4 digit Pin Code is only active for the current logged in session:

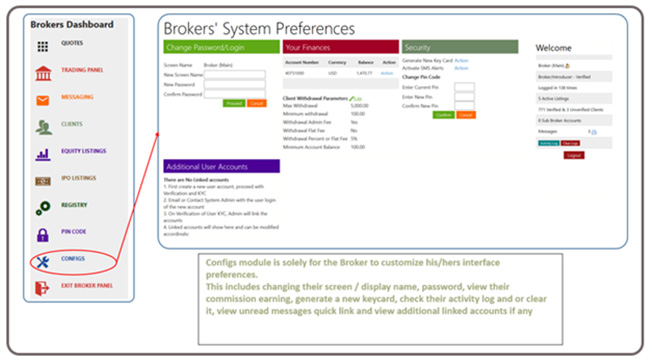

CONFIGS

Configs module is solely for the Broker to customize his/hers interface preferences.

This includes changing their screen / display name, password, view their commission earning, generate a new keycard, check their activity log and or clear it, view unread messages quick link and view additional linked accounts if any:

EXIT

Clicking on the ‘Exit Broker Panel’ module safely and securely logs the user out of the AltSX site.

Please note that if there is ten (10) minutes of inactivity on the current logged in session the System will automatically log the user out for security purposes:

COMPANY DASHBOARD

GETTING STARTED

- Once you have successfully logged into the AltSX website the below screen shot, upon every successful login, will appear:

After clicking on the ‘User Access Panel’ you will be entered and able to access the ‘Company Dashboard’.

The below screen shot defines the various ‘Modules’ which includes Crowdfunding, Listings, Trading, Messaging, Financials, Registry, Invoices, Compliance, Activity, KeyCard, Reminders and Exit:

CROWDFUNDING

Click on the ‘Crowdfunding’ module to view how many Campaigns are under your control, and apply necessary actions such as Editing the Campaign, updating News Flashes and or ending the Campaign:

LISTINGS

Listings module allows the Company to view all owned Equities and IPO’s. This module also enables the ‘Adding’ of new Equities, IPO’s as well as Crowdfunding Campaigns:

TRADING

The Trading module allows the Company to view all Trades in all Listings. The module also provides various Reports and Charts calculating activity such as Visitors, Trades, Views, etc. Latest Bids and Asks are also displayed in the Trading module:

MESSAGING

The Messaging Panel allows the Company to view Inbox messages, send messages to Admin or Clients and view already sent messages:

FINANCIALS

The Financials module allows the Company to view current account balances, withdraw funds, check uncleared balances, transfer between accounts, credit accounts and create new accounts:

REGISTRY

The Registry module provides the Listed Equities full Register, Resolutions, Traded Shares, Shareholders, Reserved Shares, Transferred Shares, Pending Shares, Rejected Shares, as well as the ability to process the Sales Register. The added Search utility has been added for ease of access:

COMPLIANCE

The Compliance module provides a checklist of required documents by the Company. Documents are uploaded into the System the Compliance Officer receives an Alert to review. Should any documentation still need to be submitted or reviewed the Company may view the status here. When a Company logs into the System, an Alert in the form of a pop-up is generated should there be any Compliancy issues requiring attention:

ACTIVITY

The Activity module reports on all activity such as logins, transactions in Financials or even Campaign editing. All events are recorded for Compliance and Auditing purposes:

REMINDERS

Reminders can be set up by the Company. This facility acts as a calendar and when the Company logs into the System a reminder in the form of a pop-up will be displayed:

EXIT

Clicking on the Exit module the Company is safely and securely logged out of the AltSX site.

Please note that if there is ten (10) minutes of inactivity on the current logged in session the System will automatically log the user out for security purposes:

ADMIN DASHBOARD

GETTING STARTED

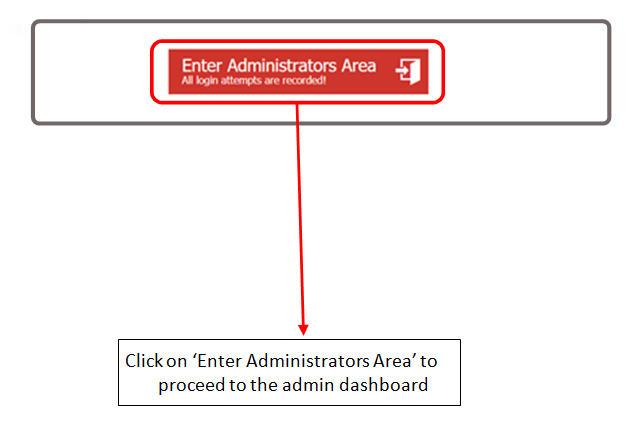

- Once you have successfully logged into the AltSX website the below screen shot, upon every successful login, will appear:

After clicking on the ‘Enter Administrators Area’ you will be entered and able to access the ‘Admin Dashboard’ which includes All Items, Messaging, Users, Crowdfunding, Equity, Compliance, Trading, Accounting, Registry, Wizards, SQL Data Tables (not in this documentation) and Configs modules:

ALL ITEMS

Click on the ‘All Items’ module to view any ‘Flagged Items’. The Admin will be able to view the ‘Flagged Item’ in detail, clear the ‘Flagged Item’ or report the ‘Flagged Item’:

MESSAGING

The Messaging module allows the Admin to receive and review any message sent by any user:

USERS

The Users module allows the Admin to view all aspects and details of all users, as well as individual Users extending from their personal details which can be edited to their ‘Know Your Client’ (KYC) documentation. The Admin may also review uploaded documentation by the User during the Sign-Up Process and upload additional documentation on or behalf of the User. The Admin may also initiate password resets sent via email to the user, and or delete user accounts:

CROWDFUNDING

The Crowdfunding module allows the Admin to perform a multitude of tasks, including Campaign editing, view investor contributions, changing the Campaigns Status right through to Ending the Campaign:

EQUITY

View the existing Equity and IPO Listings. A checklist of required documentation for Compliance is available for review. This module also allows the Admin to set up new Equities and IPO’s on or behalf of the Company or Broker:

COMPLIANCE

Compliance has to review all user applications and uploaded documents. Once documents have been reviewed the user, company or campaign can be set to LIVE status. Compliance has the ability to ‘Over-Ride’ non-compliant applications and set the request to LIVE:

TRADING

The Trading module….:

The below process flow defines the ‘Selling’ of shares for a Client:

The below process flow defines the ‘Buying’ of shares on or behalf of a Client:

The below process flow defines how to update or delete your bids or asks:

REGISTRY

The Registry module provides the Listed Equities full Register, Resolutions, Traded Shares, Shareholders, Reserved Shares, Transferred Shares, Pending Shares, Rejected Shares, as well as the ability to process the Sales Register. The added Search utility has been added for ease of access:

ACCOUNTING

The Accounting module is designed for the Administrator to be able to debit and credit investors, brokers and issuers:

WIZARDS

The below screen shot shows the Wizards module, and module that will assist and alleviate the Admin roles and responsibilities on a day to day basis. This section will be defined in detail in the AltSX – Admin Training Guide on Wizards. This section will also display immediate up to date actions required by the Administrator such as resolving Flagged Items (discussed in the first module of this section):

CONFIGS

This is the Global System Configuration (GSC) module. The Company configurations will be initially setup by the iFundX developers and sales force responsible for the company account. The Administrator will be responsible for changes thereafter, or request support depending on the Service Level Agreement in place (AdHOC / Monthly or Annual support charges).

The below screen shot is an indication of the GSC and its parameters, and will be discussed in detail in the Admin Training Guide for Global System Configurations:

EXIT

Please ensure that you exit the Administrators platform, there is no timeout session by default unless this is specifically requested by the Company. Either method the Administrator will be accountable for changes, understanding that all data is logged and captured for auditing and accountability purposes.

COMPLIANCE (BROKER ‘A’ / ADMIN ‘B’ / COMPANY ‘C’)

(A) Broker Process:

The Broker will have access to a ‘Compliance’ module which will enable him to perform and review the following criteria:

- View ‘NEW’ listings whereby he/she have been the selected Broker.

There are four (4) application / Board types (Standard, Main, Prime and IPO).

Each Board type documentation required needs to be defined by Ryan and depending on which Board the applicant has selected / applied for there needs to be a ‘Checklist’ matching, ticking or still required documentation.The Broker may perform the following based on the application:- Upgrade or downgrade the board type depending on the documentation submitted. In this event the Company is alerted to ‘Decline’ or ‘Approve’ the change. If Company ‘Declined’ the application will be moved into the ‘Declined’ database table. If ‘Approved’ an alert to Admin to ‘Decline’ or ‘Approve’ must be sent. If Admin ‘Declines’ the application will be moved into the ‘Declined’ database table. If Admin ‘Approved’ the application an alert to Broker must be sent informing them they may continue to the ‘Application Section’.

- Approve the Board type and the Broker is directed to the ‘Application Section’.

- View existing listings under their control.

Broker will be able to view all listings under their control, and the ‘Search Bar Utility’ to be included in this section as in point3. - Be able to search ‘NEW’ and ‘EXISTING’ listings:

- Search Bar Utility

The Search Bar must have the below inserted into a drop down list, and then a ‘Type Text Field’ next to the drop down box to type and filter the selected request (default application listing in date order – oldest to newest):- Date of application (date range and or exact date)

- Board / Market

- Industry (all deals within that Industry)

- Market Capitalisation

- Size of Investment required (range, i.e. 100 000 – 300 000, etc.)

- Email of applicant

- Company registration number

- Company name

- Symbol

- Location (Country and Province)

- ISIN

- Broker – all deals under that one Broker

- Currency – all deals within that currency

- Director – All deals that person is a Director of

- Clearing Firm – all deals clearing with that Clearing Firm

- Company Secretary

- Auditor

- Registrar

- Company Lawyer

- Company Advisor

- Application SectionThe ‘Application Section’ refers to the required documents that need to be uploaded depending on which Board has been selected (Ryan to define Board documentation lists)A checklist matching, ticking or still required documentation must be displayed.Each listed / required documentation must have an upload utility to perform the action. This upload utility will not allow the Broker, nor the Company to delete any documents.The required document list is as follows:

- Admission document

- Prospectus

- Financial Accounts

- Cash flow projections for five (5) years forecasting

- Working capital comfort letter

- Incorporation documents

- Analyst, Research or Valuation Statement / Report

- Company Due Diligence Report

- Shareholder database list (CSV format)

- Original application forms (AP1, AP2 and AP3)

AP1, AP2 and AP3 document upload must lock after the action is completed.

Once the required document ‘Checklist’ is ticked the ‘SUBMIT’ button highlights.

This will alert Admin to ‘Decline’ or Approved’. There must be a drop down list ‘Declined’ (move to ‘Declined’ database table) and ‘Pending’ (move to ‘Pending’ database table). Both actions must give Admin the opportunity to provide a reason. If Admin ‘Declines’ (either action in drop down) an alert to Company and Broker must be sent. If Admin ‘Approved’ and alert to Company must be sent.

- Search Bar Utility

- Crowdfunding for Broker to be able to view Campaigns as a non-verified / registered user would (this may let the Broker inform current Investors of Campaigns they would be interested in). Just enhancing visibility, but this facility must be built with an on/off switch.

(B) Admin Process:

The Admin will have access to a ‘Compliance’ module which will enable him to perform and review the following criteria:

-

- View ‘NEW’ listings.

There are four (4) application / Board types (Standard, Main, Prime and IPO).

Each Board type documentation required needs to be defined by Ryan and depending on which Board the applicant has selected / applied for there needs to be a ‘Checklist’ matching, ticking or still required documentation.

The Admin may perform the following based on the application:

- Upgrade or downgrade the board type depending on the documentation submitted. In this event the Company is alerted to ‘Decline’ or ‘Approve’ the change. If Company ‘Declined’ the application will be moved into the ‘Declined’ database table. If ‘Approved’ an alert to Admin to ‘Decline’ or ‘Approve’ must be sent. If Admin ‘Declines’ the application will be moved into the ‘Declined’ database table. If Admin ‘Approved’ the application an alert to Broker must be sent informing them they may continue to the ‘Application Section’, or the Admin may continue to review the ‘Application Section’ documentation’

- Approve the Board type and the Broker is directed to the ‘Application Section’, or the Admin may continue to review the ‘Application Section’ documentation.

- View all existing listings. Admin will be able to view all listings, and the ‘Search Bar Utility’ to be included in this section as in point3.

- Be able to search ‘NEW’ and ‘EXISTING’ listings:

- Search Bar UtilityThe Search Bar must have the below inserted into a drop down list, and then a ‘Type Text Field’ next to the drop down box to type and filter the selected request (default application listing in date order – oldest to newest):

- Date of application (date range and or exact date)

- Board / Market

- Industry (all deals within that Industry)

- Market Capitalisation

- Size of Investment required (range, i.e. 100 000 – 300 000, etc.)

- Email of applicant

- Company registration number

- Company name

- Symbol

- Location (Country and Province)

- ISIN

- Broker – all deals under that one Broker

- Currency – all deals within that currency

- Director – All deals that person is a Director of

- Clearing Firm – all deals clearing with that Clearing Firm

- Company Secretary

- Auditor

- Registrar

- Company Lawyer

- Company Advisor

- Application SectionThe ‘Application Section’ refers to the required documents that need to be uploaded depending on which Board has been selected (Ryan to define Board documentation lists)A checklist matching, ticking or still required documentation must be displayed.

Each listed / required documentation must have an upload utility to perform the action. This upload utility will allow the Admin to delete or upload any documents.The required document list is as follows:- Admission document

- Prospectus

- Financial Accounts

- Cash flow projections for five (5) years forecasting

- Working capital comfort letter

- Incorporation documents

- Analyst, Research or Valuation Statement / Report

- Company Due Diligence Report

- Shareholder database list (CSV format)

- Original application forms (AP1, AP2 and AP3)

AP1, AP2 and AP3 document upload must not lock after the action is completed.

After the ‘Application Section’ documentation has been reviewed and ticked off against the ‘Checklist’ the Admin will either ‘Decline’ or ‘Approved’ the submission. There must be a drop down list ‘Declined’ (move to ‘Declined’ database table) and ‘Pending’ (move to ‘Pending’ database table). Both actions must give Admin the opportunity to provide a reason. If Admin ‘Declines’ (either action in drop down) an alert to Company and Broker must be sent. If Admin ‘Approved’ and alert to Company must be sent.

- Search Bar UtilityThe Search Bar must have the below inserted into a drop down list, and then a ‘Type Text Field’ next to the drop down box to type and filter the selected request (default application listing in date order – oldest to newest):

(C) Company Process:

The Company will have access to a ‘Compliance’ module which will enable him to perform and review the following criteria:

- View all existing Board equity’s.

- Have access to an ‘Exchange Notification Panel’.The ‘Exchange Notification Panel’ is to enable the Company to update any and all documentation that is regulated and required for compliancy. The Admin has ‘Reviewable’ and ‘Non-Reviewable’ criteria that has split process:

- Compliance Reviewed Changes:

- Directors – Company must be able to add or remove Directors.

Adding a Director must have a document upload section which requires a new AP2 form (make available), their Curriculum Vitae, Resolution accepting Director, for internal use and enter new Directors information in online form and the Press Release.

Once the ‘Checklist’ of required documents have been ticked, a ‘SUBMIT’ button highlights which then alerts Admin for review. Admin will publish the Press Release.

Removing a Director must have a documentation upload section which requires the following documentation (Resignation Letter, Resolution accepting the Resignation and the Press Release).

Once the ‘Checklist’ of required documents have been ticked, a ‘SUBMIT’ button highlights which then alerts Admin for review. Admin will publish the Press Release.

- Company Name – Document upload section which requires the following documents (Company Name Change Resolution, proof form from Country Department on reasons for change, the proof of name change approval and the Press Release).

Once the ‘Checklist’ of required documents have been ticked, a ‘SUBMIT’ button highlights which then alerts Admin for review. Admin will publish the Press Release.

- Secretary – Same as Directors with no AP2 form.

Once the ‘Checklist’ of required documents have been ticked, a ‘SUBMIT’ button highlights which then alerts Admin for review. Admin will publish the Press Release.

- Compliance Non-Reviewed Changes

- Auditor – Must be able to change what is said on the Web.

- Registrar change.

- Company Lawyer change.

- Company Advisor.

- Clearing Firm.

- Broker change.

- Email address change.An alert for each of the above changes to go to Admin, Admin will publish the Press Release.

- Compliance Reviewed Changes:

- Documentation Section whereby the Company will be able to upload the following documentation for updates for regulation and compliance:

- Financials (Non-Reporting, Quarterly, Semi / Bi-Annual and Annual).

- Prospectus.

- Incorporation Documents.

- Admission Documents.

- Working Capital.

- Cash Flow Projections.

- Analyst, Research / Valuation Statement / Report.

- Additional / Any Reports.

The Company will not be able to delete any previously uploaded documents, only upload new or updated ones.

If there is a submission / upload on any of the above documents Admin will be alerted to ‘Decline’ or ‘Approved’. If Admin ‘Declined’ then an alert to Company with Admin’s reason must be sent. If Admin ‘Approved’ the Admin publishes the Press Release and an alert to Company sent.